Optimize and automate your warehouse funding.

- Reduced interest and fee expense

- Frictionless & fully automated transactions

- Simplified and standardized warehouse funding process

- Robust data analytics & actionable insights

- Proactive warehouse line management

When you integrate with OptiFunder, you become apart of a secure, fully-automated Warehouse Management System.

OptiFunder was developed for Mortgage Originators to methodically decision where to fund loans and automate the process from funding to loan sale.

-

Warehouse Select

-

Wire Data Check

-

Funding Automation

-

Shipping Automation

-

Purchase Advice

-

Paydown Requests

-

Smart Analytics

.png)

Patented algorithm to achieve the lowest cost of warehouse financing

Add a layer of protection against wire fraud.

Automatically check payees account and bank routing numbers against our extensive transaction database.

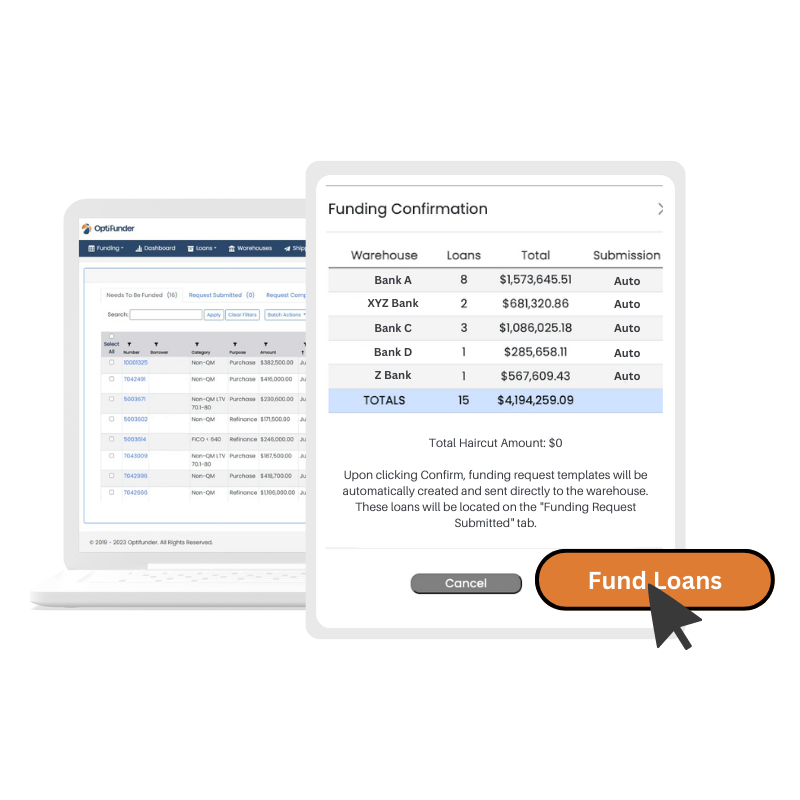

Funding request documents at the press of a button

Create and send wire requests, receive fed reference numbers, and update LOS fields automatically.

.png)

Reduce dwell time by automating collateral status tracking and shipping requests.

Our Shipping module offers a consolidated view of funded loans categorized by Wet/Dry collateral status and enables automated shipping and payoff requests to warehouse banks.

.png)

Expedite Purchase Advise and warehouse line paydown requests.

Expedite warehouse line paydown requests by automating Purchase Advice retrieval, reconciliation, reporting and write-back to the LOS. OptiFunder retrieves, reads and reconciles 100s of Purchase Advances in minutes.

.png)

Automatically send paydown requests to the warehouse banks

Expedite warehouse line paydown requests by automating Purchase Advice retrieval, reconciliation, reporting and write-back to the LOS. OptiFunder retrieves, reads and reconciles 100s of Purchase Advances in minutes.

%20(7).png)

Reports and actionable insights on all your warehouse lines

Actual and projected expenses are available in snapshot, graphs and detail. Plus, you can easily export to MS Excel.

Integrated with nearly 100 warehouse banks, vendors and LOS systems

Here's What Our Clients Have to Say

"We're excited to harness warehouse optimization to help manage the bottom line and the efficiency gain from automated funding and post-closing to make us even more competitive.”

"After our OptiFunder demo, we knew we could achieve significant savings. We moved quickly to implement; within a month we were able to start reducing expenses and automating processes."

"OptiFunder has enhanced our ability to manage loans beyond closing in the LOS. We now have full visibility through loan sale."