Simplify funding through paydown

Optimize and automate the entire warehouse funding process

From optimized selection of warehouse to automated funding through paydown, OptiFunder streamlines post-closing so your team can focus on what matters most.

-

Optimization

-

Wire Data Checks

-

Funding Automation

-

Shipping Automation

-

Purchase Advice

-

Reporting

.png)

Automatically select the best warehouse on your terms

Genesis by OptiFunder automatically tells you where to fund your loans to achieve optimized warehouse expense based on factors such as capacity, sub-limits, product eligibility, curtailments, interest rates, funding & non-use fees, and rebate incentives.

Automatically check wire data for an added level of pretection

Automatically check payees account and bank routing numbers against our extensive transaction database.

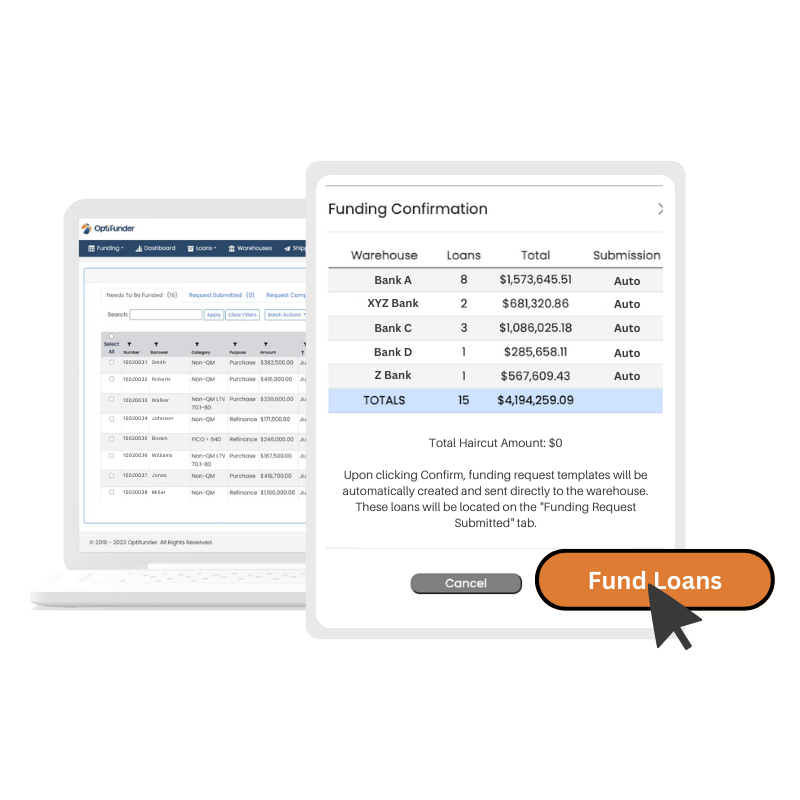

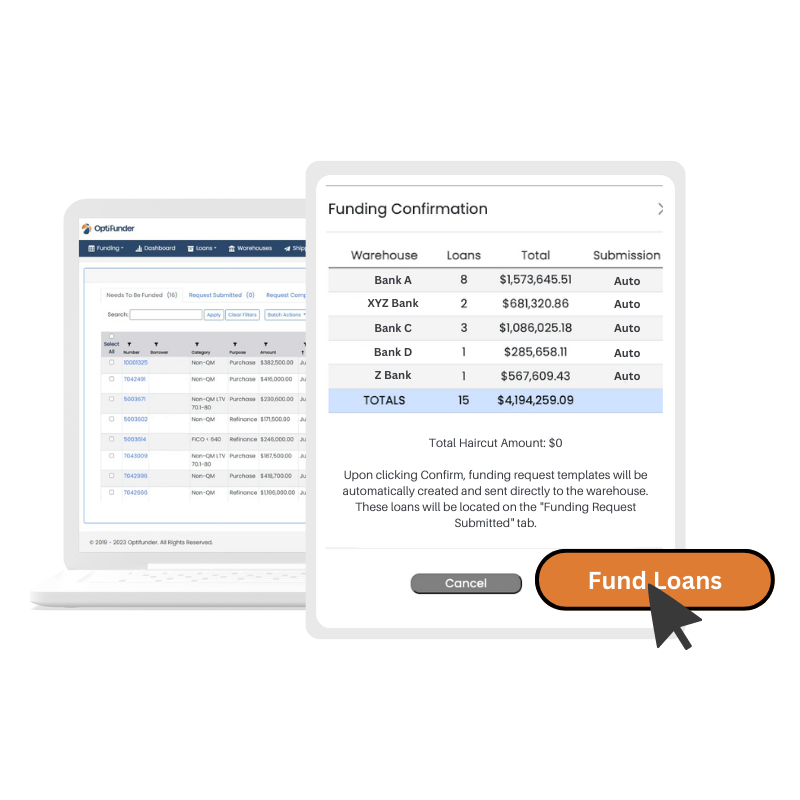

Batch funding requests at the press of a button

Create and send wire requests, receive fed reference numbers, and update LOS fields automatically.

.png)

Automate collateral status tracking and shipping requests to reduce dwell

Our Shipping module offers a consolidated view of funded loans categorized by Wet/Dry collateral status and enables automated shipping and payoff requests to warehouse banks.

.png)

Automatically reconcile purchase advice and LOS write-back

Expedite warehouse line paydown requests by automating Purchase Advice retrieval, reconciliation, reporting and write-back to the LOS. OptiFunder retrieves, reads and reconciles 100s of Purchase Advances in minutes.

%20(7).png)

Customizable, exportable reports

Actual and projected expenses are available in snapshot, graphs and detail. Plus, you can easily export to MS Excel.

Reduce warehouse expense and eliminate manual post-closing processes.

For CEOs & CFOs

Reduce your 2nd biggest P&L line item, provide line reporting and aggregate ROE analytics for warehouse management.

For Operations

Request hundreds of wires from multiple warehouse lenders and complete monotonous data entry tasks in seconds.

For Accounting

Automate daily wire and purchase advice receipt, reconciliation and LOS updates with clean data and easy to extract reporting.

Here's What Our Clients Have to Say

OptiFunder has been a huge part of our growth story. In 2025, we closed about $3.5 billion in loans, and projecting nearly $4 billion for the following year—all without adding more funders. We’ve kept the same team of four funders for three years while increasing volume by 30%. The impact on profitability has been significant—we went from losing money on net interest margin to being in the positive.

Michael Kennemer

CFO | Neighborhood Loans

By implementing OptiFunder, we've been able to optimize our warehouse bank selection with ease. Execution was a breeze, and we were thrilled to achieve quick ROI while consistently improving our spread. This technology has allowed us to expand our business efficiently and effectively.

Phil Shoemaker

CEO | The Loan Store

We were an early OptiFunder customer and have since added every feature. We're more efficient with OptiFunder, and able to focus more of our operations resources on supporting originations.

Matthew Roberts

CFO | GoPrime Mortgage

.png)

.png)

.png)

Warehouse management is complicated and disconnected.

Independent mortgage originators utilize multiple revolving funding facilities to fund their loans, all of which have unique terms and restrictions making it impossible to know which line to use to fund every loan.

The mortgage originators’ systems are not connected to the warehouse lenders’ systems which are not connected to the document custodians’ systems creating inefficient and costly transactions.

%20(5).png)

OptiFunder makes it easy by streamlining the process and connecting all participants.

OptiFunder leverages a proprietary optimization algorithm to optimize the loan funding decision and significantly reduce effective cost of warehouse.

OptiFunder integrates the mortgage originator, warehouse lender, document custodian, and investors providing a seamless funding transaction.

Achieve Lowest Cost of Capital and Increase Return on Investment

OptiFunder uses machine learning and artificial intelligence (AI) to systematically decision where to fund loans on given warehouse lines based on unique loan eligibility characteristics, warehouse terms, pricing, and the lenders' financial objective.

Whether it is to achieve lowest cost of capital or return on equity, our propriety algorithm takes the manual guesswork out of warehouse lending.

.png)

Genesis by OptiFunder helps IMBs reduce warehouse expense by optimizing loan decisions. With the added efficiency gains of automating funding through loan sale, the return on investment is noticeable.