.png)

A highly configurable, modern-day warehouse lending solution.

Greyhound by OptiFunder provides new options for warehouse lenders looking for alternatives to legacy solutions.

Scale your business with effortless client onboarding, robust reporting, and simple loan ingestion from originators.

With its security-first design, highly configurable workflow, seamless integrations, and unparalleled efficiency, Greyhound is an ideal fit for warehouse lenders looking to grow market share in today’s challenging environment.

“We wanted to create a platform for warehouse lenders that would run independent of OptiFunder but leverage the same technology and incredible team. While Greyhound represents a new brand, the underlying software, configurability, and proven rules engine have already routed and funded nearly a million loans with over 70 warehouse lenders.”

Simplify workflow and increase process automation.

Automate all aspects of warehouse lending, streamline funding, shipping, and paydown requests, and gain insights with transparent reporting.

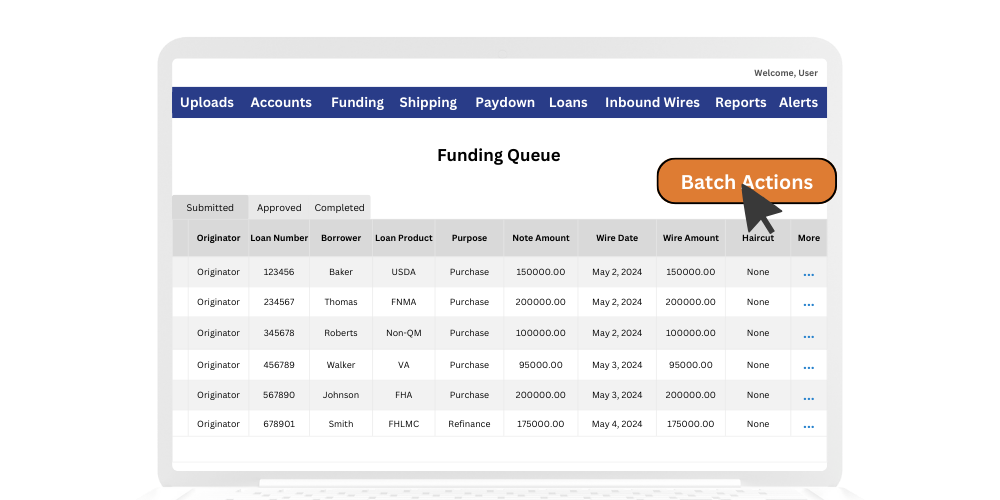

Funding Requests

Streamline your process with configurable relationships and templates to ingest actionable data as part of wire approval flow.

Shipping Requests

Know exactly where documents are, where they are going, and when they arrive at their final destination.

Paydown Requests

Simplify processing of paydown requests and matching inbound wires with PA data to reconcile payments.

Greyhound is transforming warehouse lending by giving lenders the ability to manage their clients better.

Made for Warehouse Lenders

Gain real-time, immediate insights into pipeline management, loan and collateral tracking, and operational reporting.

Increase Profit and Efficiency

Automate operational pricing, investor shipping requests, purchase advice matching and document imaging.

Improve Security and Risk Management

Mitigate operational and credit risks with data validation controls and decision logic.

Move Money Easier

Link your Settlement Agent, Investor, Disbursement Account, Haircut Account, and Settlement Account to move money easier.

Achieve Lowest Cost of Capital and Increase Return on Investment

OptiFunder uses machine learning and artificial intelligence (AI) to systematically decision where to fund loans on given warehouse lines based on unique loan eligibility characteristics, warehouse terms, pricing, and the lenders' financial objective.

Whether it is to achieve lowest cost of capital or return on equity, our propriety algorithm takes the manual guesswork out of warehouse lending.

.png)