GREYHOUND BY OPTIFUNDER

A highly configurable, SaaS-enabled platform that helps warehouse lenders manage the full lifecycle of their operation.

FEATURES & INTEGRATIONS

Standardize where it matters. Customize where it counts. Automate the rest.

An alternative to legacy systems, Greyhound helps you grow efficiently with simple loan ingestion from originators, fast onboarding, and robust, transparent reporting—all in a security-first framework with configurable workflows and integrations.

-

Funding Requests

-

Shipping Requests

-

Paydown Requests

-

Integrations

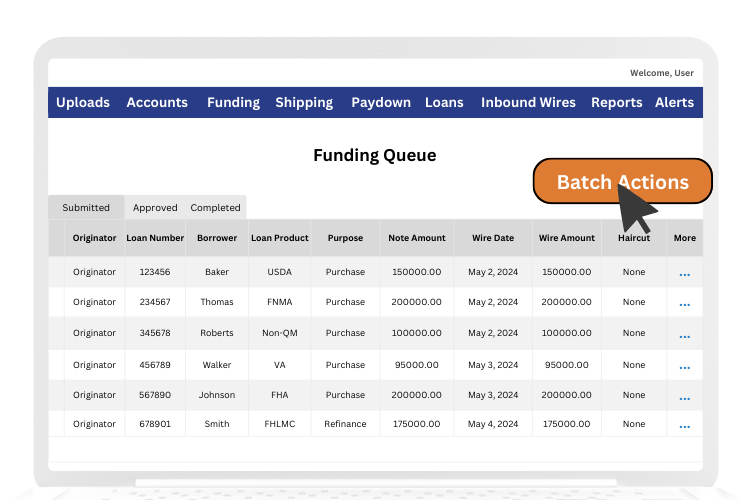

Turn funding approvals into a repeatable, controlled workflow

Configure relationships, templates, and required fields so originators submit actionable data that supports your wire approval flow—with fewer back-and-forths and stronger validation from the start.

- Configurable request templates and data requirements

- Built to support consistent review and approval steps

- Improves visibility into pipeline and funding activity

Reconcile repayments with less manual effort

Simplify paydown processing by matching inbound wires to purchase advice data to help your team reconcile payments more efficiently and reduce operational friction.

- Wire-to-purchase-advice matching to support reconciliation

- Streamlines paydown workflows and reduces exception handling

Integrations that fit your ecosystem

Get trusted data and risk signals earlier—without hopping between systems. Today’s warehouse lending teams rely on timely, verified information—without rekeying data or waiting on manual checks. Greyhound by OptiFunder integrates with your existing tools to keep workflows connected and decisioning consistent.

- LOS connectivity to support loan data flow and ingestion

- Risk & fraud signals for identity, property, and collateral insights

- Wire instruction validation to support safer disbursements

- eVaults for secure transactions and status tracking

- Additional connectivity to general ledger, wire systems, DDA systems, and other third-party tools available

WHY GREYHOUND?

Built to help you scale—without scaling complexity

Greyhound by OptiFunder helps warehouse lenders manage clients more effectively with real-time insight, automation opportunities, and stronger operational controls.

Made for Warehouse Lenders

Gain real-time, immediate insights into pipeline management, loan and collateral tracking, and operational reporting.

Increase Profit and Efficiency

Automate operational pricing, investor shipping requests, purchase advice matching and document imaging.

Improve Security and Risk Management

Mitigate operational and credit risks with data validation controls and decision logic.

Move Money Easier

Link your Settlement Agent, Investor, Disbursement Account, Haircut Account, and Settlement Account to move money easier.

Learn more about Greyhound by OptiFunder

Improve The Bottom Line

Achieve Lowest Cost of Capital and Increase Return on Investment

OptiFunder uses machine learning and artificial intelligence (AI) to systematically decision where to fund loans on given warehouse lines based on unique loan eligibility characteristics, warehouse terms, pricing, and the lenders' financial objective.

Whether it is to achieve lowest cost of capital or return on equity, our propriety algorithm takes the manual guesswork out of warehouse lending.

.png)